Before discussing some of the challenges and opportunities for you to better understand your adoption, utilization and potential savings for your Salesforce investments, it’s important to recognize that for most customers, their relationship with Salesforce is positive, mutually beneficial and mission critical, meaning most customers will not consider another CRM solution for the foreseeable future. Many procurement professionals and executives will ask, “Can’t we shop this out?” Even if another option is considered (some customers are using Microsoft Dynamics ERP and have migrated to the Microsoft CRM solution) and works great for them. But for most customers, the migration plan to change to a new CRM solution is too disruptive. And since Salesforce is the established market leader in this space, it can be hard to justify.

There are some products that can be compared and these could provide negotiation leverage at renewal time. For example, there are reporting tools like Tableau versus Power BI, and collaboration tools like Teams versus Slack.

How Salesforce stays sticky

One of the ways Salesforce has built and maintained such great relationships with their customers is by delivering the features that provide strategic and economic business value to their customers over time, and by offering licensing that makes it fair and manageable. One of these offerings is called a restricted use license—a great option for customers to purchase licenses at a lower cost for groups of users that will only partially use all the features of the full-price license.

This causes some challenges. Foremost is that customers are responsible for being in compliance with those requirements and being out of compliance can be costly. This becomes more challenging if you have groups of users in a single organization (org) that have a mix of full and restricted use licenses. You’ll see this language highlighted in your contract and these licenses are normally managed through a user profile.

Another option customers can take advantage of is the ability to purchase licenses that are capped or uncapped for both Salesforce and customers. Many customers will have a blend of capped and uncapped licenses with capped licenses being advantageous because they can be purchased at a lower cost. The risk, however, is that if you go over your capped license amount—which depends on the terms you have negotiated for any overages—your cost typically will become full list price. If you can accurately forecast your license usage (with data from Flexera, for example) you can better understand what blend of capped and uncapped licenses work best for you.

Multiple Salesforce orgs? No problem

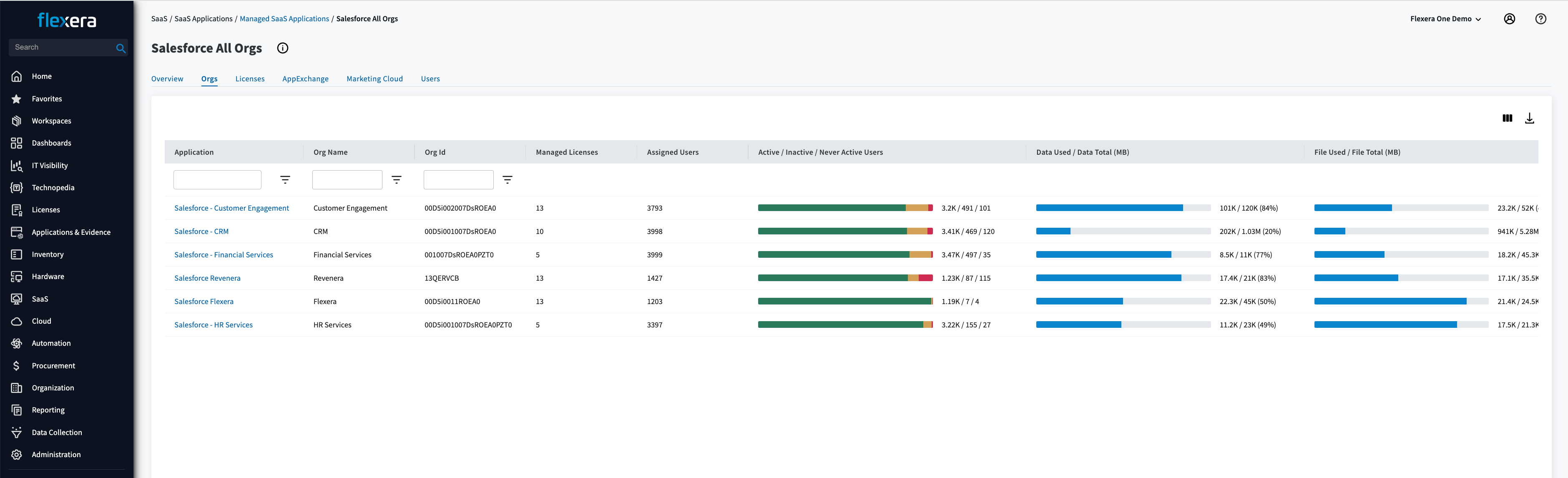

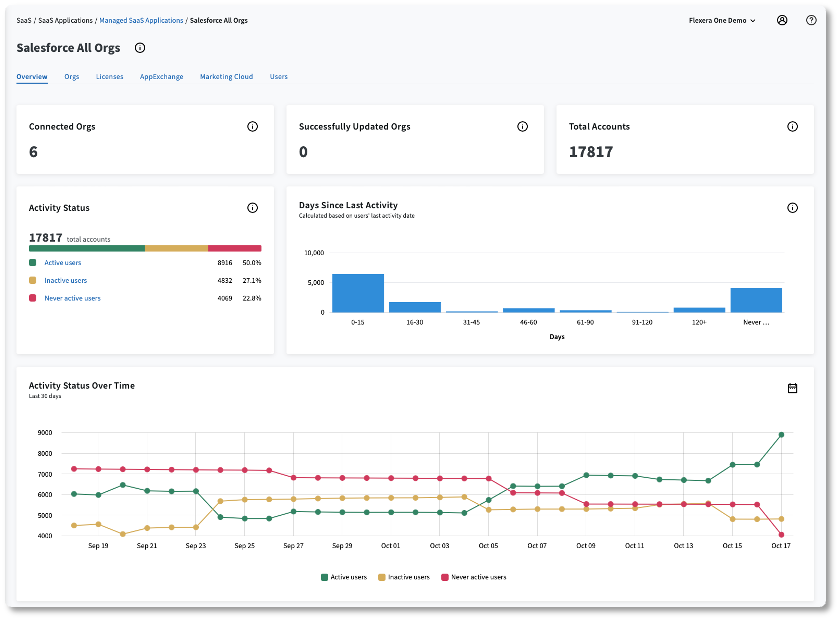

Most customers have multiple orgs. There is no easy or automated way to see a rolled-up view of all orgs users, licenses, usage and other items like storage, full copy sandboxes, etc. But Flexera One Select for Salesforce does all this and more. When customers gain the insights from Flexera about all their spend and usage for each of their licenses across all of their orgs, they typically are in a better position to review their org strategy, which begs the question, “How many orgs do we need?”

One reason some customers don’t review their org strategy often is because some migrations can be costly and complex. Customers also have to think about their orgs strategy in light of many variables, including, but not limited to, their acquisition and divestiture strategy, the complexity of a chargeback methodology, costly licenses like Shield which not all users may need, and the amount of customizations developed on each org.

See all your Salesforce orgs in a single space

For acquisitions and divestitures, having separate orgs makes life easy. If you have custom-developed applications on the Salesforce platform, under IAS 38 rules, they may be treated as intangible assets rather than operating expenses, which is another important consideration as most SaaS investments are treated as an operating expense.

Make complex Salesforce org updates simple

Flexera One Select for Salesforce can make complex chargebacks to business units on multiple or single large orgs simple, automated and accurate.

For groups of users requiring expensive licenses that are charged as a percentage of the contract—again, like Shield for example—grouping these users into a single org makes economic sense for some customers but it needs to be aligned with the org strategy.

Another challenge Flexera will help solve is SKU mapping. The problem is that many times licenses provisioned in the Salesforce portal do not match the license names in the contract, making it almost impossible for an IT asset manager or purchasing manager to analyze costs and validate license spend and usage. Essentially, knowing how much you need is typically based on what was provisioned. According to analysts and Flexera’s most recent State of ITAM Report, SaaS licenses on average are around 30 percent unused or underutilized. Seeing the licenses and quantities of what you purchased—compared to what was provisioned and what is being used—is easily seen and updated daily by Flexera. More important is the saving of two years of historical data. Without it, even if you see a rollup view of all your orgs, licenses, users and usage, you still don’t know how this maps to what you actually purchased and are contractually obligated to be in compliance with.

View your Salesforce estate trends and take action

What do I do when I’ve got good Salesforce org data?

The key is to have the fundamental knowledge and understanding of how the licensing works on this large, complex platform, which will enable you to focus on the things that matter most. The data will provide the meaningful insights to help you navigate all these challenges.

Flexera One Select for Salesforce includes out-of-the-box reports ready to deliver value to each of the people in your organization who care the most, from your procurement teams, IT asset management, planning and finance, FinOps and application owners and administrators.

IT Asset Management

It all starts with knowing what’s in your IT ecosystem. Flexera One discovers even the most elusive assets whether on-prem, SaaS, cloud, containers and more.

Want to learn more? Download our white paper.

See a demo or start a free trial today.