In today’s rapidly evolving IT landscape, managing software assets has become a critical challenge for organizations. The proliferation of SaaS subscriptions with a legacy environment of perpetual licenses has left organizations struggling with selecting a single software asset management (SAM) tool or a collection of specialized point solutions. SAM tools aim to decipher the complex world of license and SaaS subscription management. This has led to a diverse set of software asset management (SAM) requirements.

This blog explores our understanding of the key findings, recommendations and other sections from the Gartner® Market Guide for Software Asset Management Tools1, to help organizations select the right SAM tools to support their businesses.

Key findings

- The plethora of legacy perpetual licenses and the accelerated adoption of SaaS and ephemeral infrastructure have left sourcing, procurement, and vendor management leaders struggling to select a single SAM tool or a collection of specialized point solutions.

- Organizations that see SAM tools as a “silver bullet” don’t truly understand the complexity of SAM as a combination of tooling, highly skilled resources and effective processes. These organizations thus continue to struggle to obtain accurate and actionable data out of SAM tools.

- Economic headwinds and the need for strategic cost optimizations have placed cost governance as a priority for SPVM leaders. However, siloed functions and SAM tools delivering partial information hinders achieving cost governance, putting SAM teams and their tools at risk of being sidelined.

Recommendations

To overcome the challenges associated with SAM tools and optimize their usage, sourcing, procurement, and vendor management leaders must consider the following recommendations:

- Collaborate with cross-functional stakeholders to develop a clear set of measurable use cases for SAM tooling. Assess your strategic priorities as well as current and future ISV licensing requirements to determine whether a platform, stand-alone tool or point solution addresses your needs.

- Mandate as part of the RFP process that SAM tool vendors provide demonstrable examples or a POC using your sample data to validate their marketing claims of what their tools can deliver. Where gaps exist, seek out external expertise in the form of SAM managed service providers to augment tooling and staff.

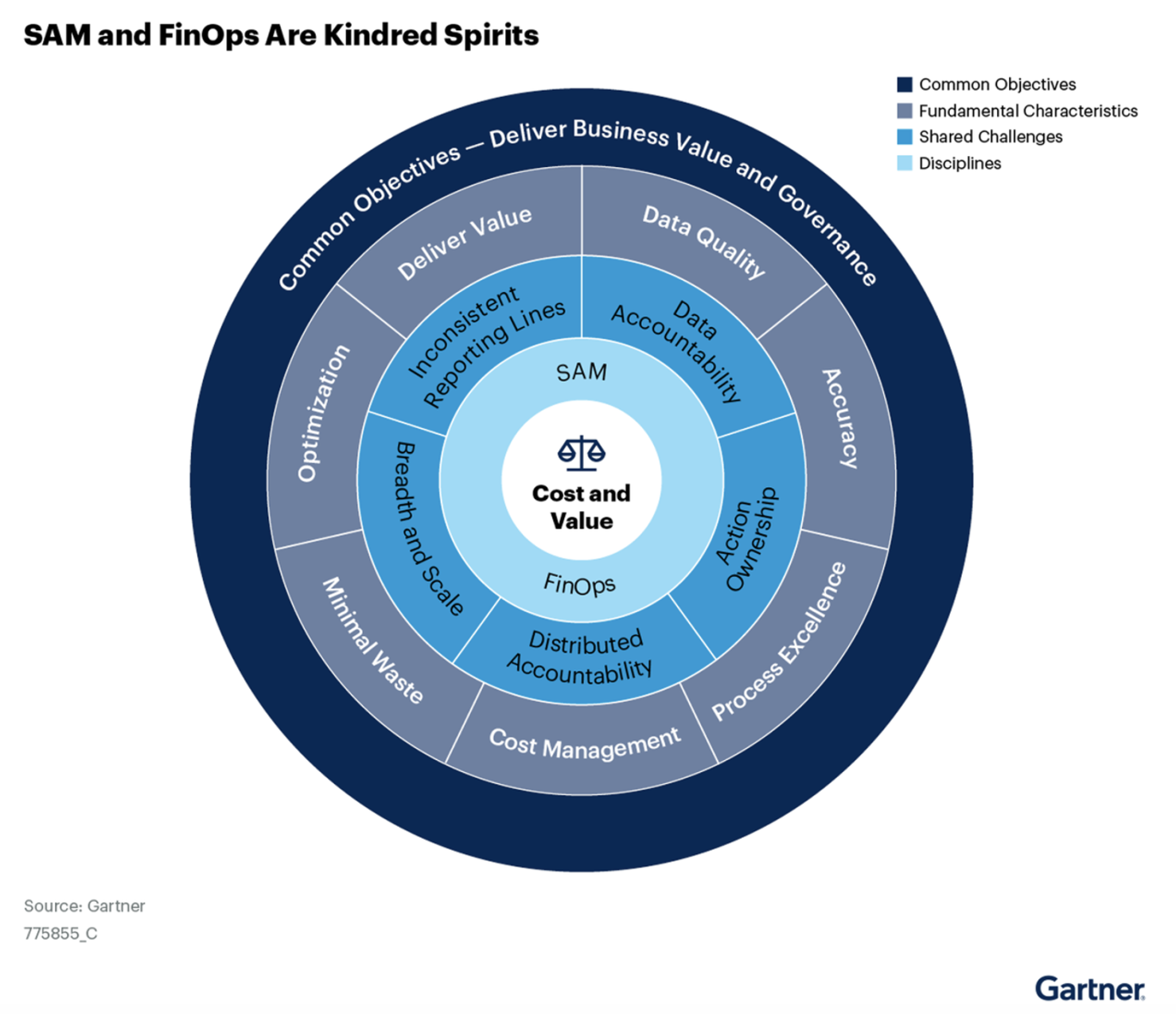

- Form strategic relationships with FinOps teams, leveraging both a combined framework to standardize on governance and complementary tool functionality to form a complete, trustworthy view of where waste can be eliminated within your organization.

Market definition and description

The report identifies SAM tools are products that automate support tasks required to produce and maintain compliance with independent software vendor (ISV) license use rights and improve organizations’ ability to optimize software risk and spend. SAM tools provide in-depth software asset analysis by decoding license entitlements, automate software consumption data collection, establish ISV effective license position (ELP), govern software assets, optimize value delivery, and share information with other tools and stakeholders.

Key activities of a SAM tool

The report outlines ten key activities that a SAM tool should possess, including:

- Platform discovery

- Entitlement discovery

- Platform consumption identification

- Entitlement identification

- Normalization of consumption data

- Normalization of entitlement data

- Reconciliation

- Governance

- Optimization

- Sharing software asset information

Market direction

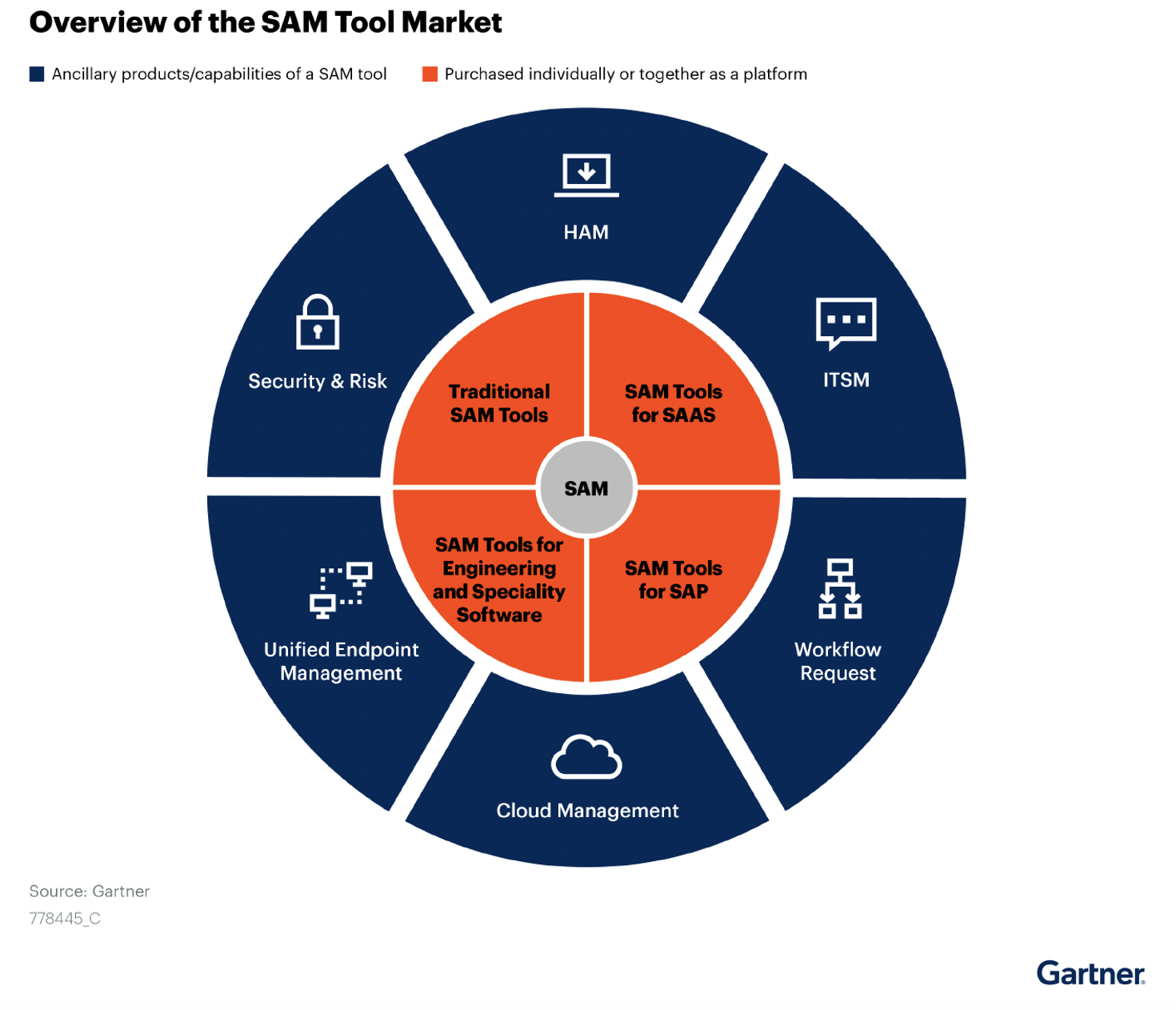

The SAM tool market has diversified to cater to four distinct categories: traditional SAM tools, SAM tools for SAP, SAM tools for engineering and specialty software and SAM tools for SaaS. The market’s evolution has increased consumer choice, but also introduced confusion for organizations in selecting the right tools. Over the next 12 to 18 months, Gartner anticipates the following market changes:

- Continued demand for SAM tools, but tools will come under greater customer scrutiny and be required to provide demonstrable proof of their actual deliverables

- Strategic alliances with partners to develop robust generative AI capabilities

- Greater crossover between SAM tools and FinOps to deliver on greater cost transparency and governance

- Organizations turning to SAM tools for sustainability reporting, such as on greenhouse gasses consumed by running software and SaaS

- Less distinction between foundational capabilities of adjacent tools such as SaaS management platforms (SMPs)

- Increased interoperability between tools and data transformation capability

- Strong relationships with managed services providers (MSPs) to take on the implementation and running of tooling to address skills gaps

- Increased demands for SAM data from cross-functional teams, such as security or enterprise architecture

Market analysis

The complexity of software licenses and evolving infrastructure pose challenges for SAM tools. SAM tool vendors focus their resources and products on their ability in supporting larger software publishers, common license types and commonly utilized infrastructure. As the software portfolio broadens, it leads to gaps in addressing custom license types and specialized vendors, products, and infrastructure. The diversified SAM tools market has seen traditional SAM tool vendors take a platform approach, moving into adjacent offerings such as IaaS management, unified endpoint management, SaaS management, workflow/request management, IT service management, vulnerability management and hardware asset management.

Traditional SAM tool vendors aim to strengthen their single platform offerings, broaden their scope and enter adjacent markets. SAM tools focusing on the niche areas and specialized software such as SAP, specialty and engineering applications and SaaS solutions are being embedded into this market. Despite how this market provides organizations with more choice than previously available, it has also heightened the confusion. The result is organizations not knowing which choice is best while struggling to find and deliver the ROI SAM tool vendors promise.

Alignment of SAM and FinOps

As organizations focus on cost optimization, SAM and FinOps functions must converge to bridge data gaps and optimize software spending. The convergence enables SAM teams to track software consumption in cloud environments, providing valuable insights for cost optimization.

IT Asset Management

It all starts with knowing what’s in your IT ecosystem. Flexera One discovers even the most elusive assets whether on-prem, SaaS, cloud, containers and more.

Representative Vendors

Flexera and Snow Software are proud to be recognized as Representative Vendors in traditional SAM tools by Gartner. You can find other vendor profiles in the full Gartner report.

Conclusion

By following the recommendations and understanding the market dynamics, sourcing, procurement, and vendor management leaders can make informed decisions to ensure SAM tools align with their strategic goals, enhance data quality, and optimize software risk and spend. Embracing the convergence of SAM and FinOps functions will further aid in achieving cost optimization and driving value from software investments. We invite you to download a complimentary copy of Gartner latest report, 4 Keys to Unlock SAM’s Strategic Value, to redefine your organization’s perception of software asset management.

1Gartner, “Market Guide for Software Asset Management Tools” by analysts Jaswant Kalay, Ciaran Hudson, and Yolanda Harris, 3 October 2023.

The graphics were published by Gartner, Inc. as part of a larger research document and should be evaluated in the context of the entire document. The Gartner document is available upon request from Flexera or Snow Software.

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose. Gartner is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. All rights reserved.