In the world of IT, rapid advancements often mean equally swift changes in budgeting and priorities. Flexera’s 2023 Tech Spend Pulse unravels the intricate web of global spend trends, providing clarity to enterprises about their strategies and choices. Through insights from more than 500 IT decision-makers, we uncovered some notable developments in technology investments.

Vendor price hikes and inflation

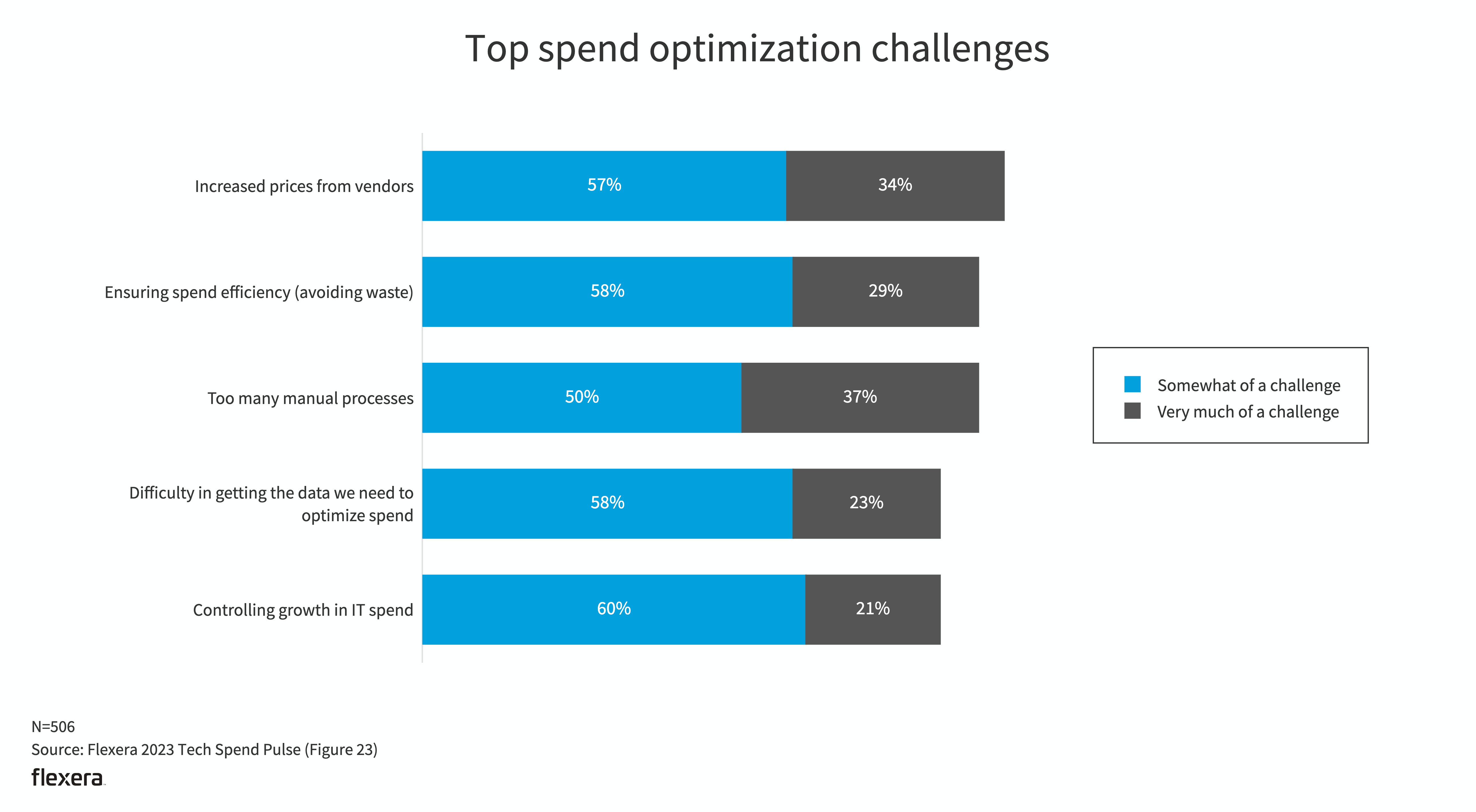

A staggering 90% of enterprises view vendor price hikes as a primary challenge, with inflation being a significant driver. As organizations push the boundaries of innovation, balancing economic constraints becomes even more paramount, especially in a post-pandemic world.

Understanding budget dynamics is crucial in an environment marked by ever-evolving challenges and opportunities. Inflation-induced pricing constraints put immense pressure on enterprises, compelling them to make judicious decisions about where and how to spend. This shift to frugality could be a double-edged sword. On one hand, it necessitates a more meticulous assessment of the ROI of every tech dollar spent, ensuring that only the most value-driven projects receive funding. On the other, it could prevent risk-taking and experimental initiatives, potentially hindering long-term innovation.

However, the focus on spend efficiency signifies a positive pivot in the business landscape. Organizations seem to be adopting a more data-driven approach, meticulously analyzing their tech spends and weeding out redundancies. This strategic spending underscores the importance of agility in the current economic climate. Data indicates a pronounced transition from traditional on-premises solutions to agile, cloud-based services. This ensures ROI is maximized and growth remains cost-effective, even as global economic pressures persist. As enterprises contend with financial concerns, there’s a clearer emphasis on deriving maximum value, ensuring sustainability and promoting growth in a tumultuous market.

Artificial intelligence and automation

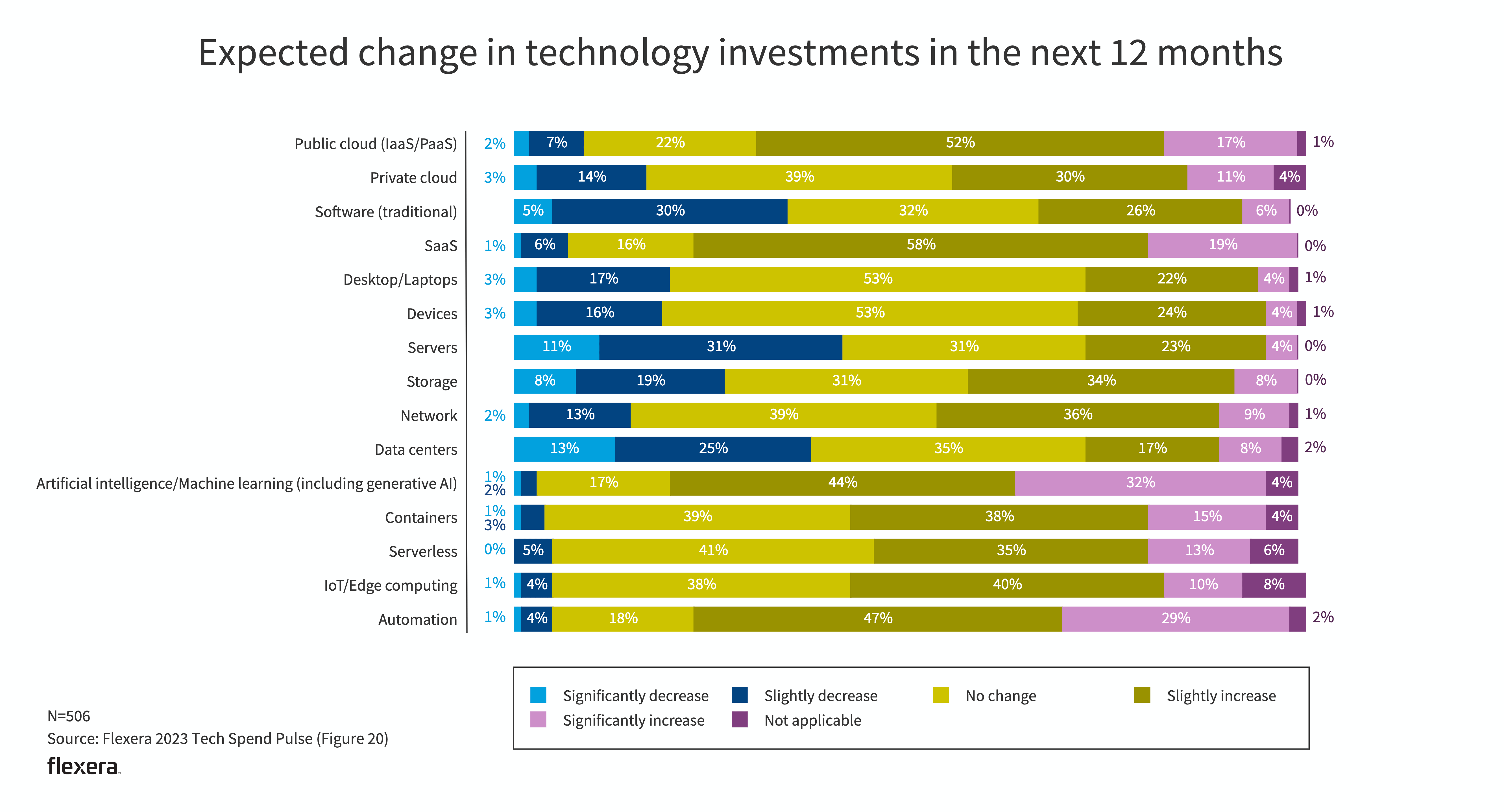

One of the standout revelations from the Pulse is the increasing investment in artificial intelligence (AI) and machine learning (ML). A significant 44% of respondents predict a slight uptick in AI and ML expenditure, while 32% anticipate a substantial surge. This trend underscores the pressing need for innovation in a cost-conscious environment. As these technologies become integral to IT solutions, enterprises are rapidly adapting to harness their game-changing potential—and revolutionizing industries in the process.

As AI and ML integrate into organizational ecosystems, there’s a major shift in how businesses perceive and respond to challenges. Advanced data analytics, predictive modeling and automation are just the tip of the iceberg when we consider the vast capabilities these technologies offer. From healthcare to finance and retail, AI and ML are redefining norms and creating unprecedented value propositions.

A shift in employee investments

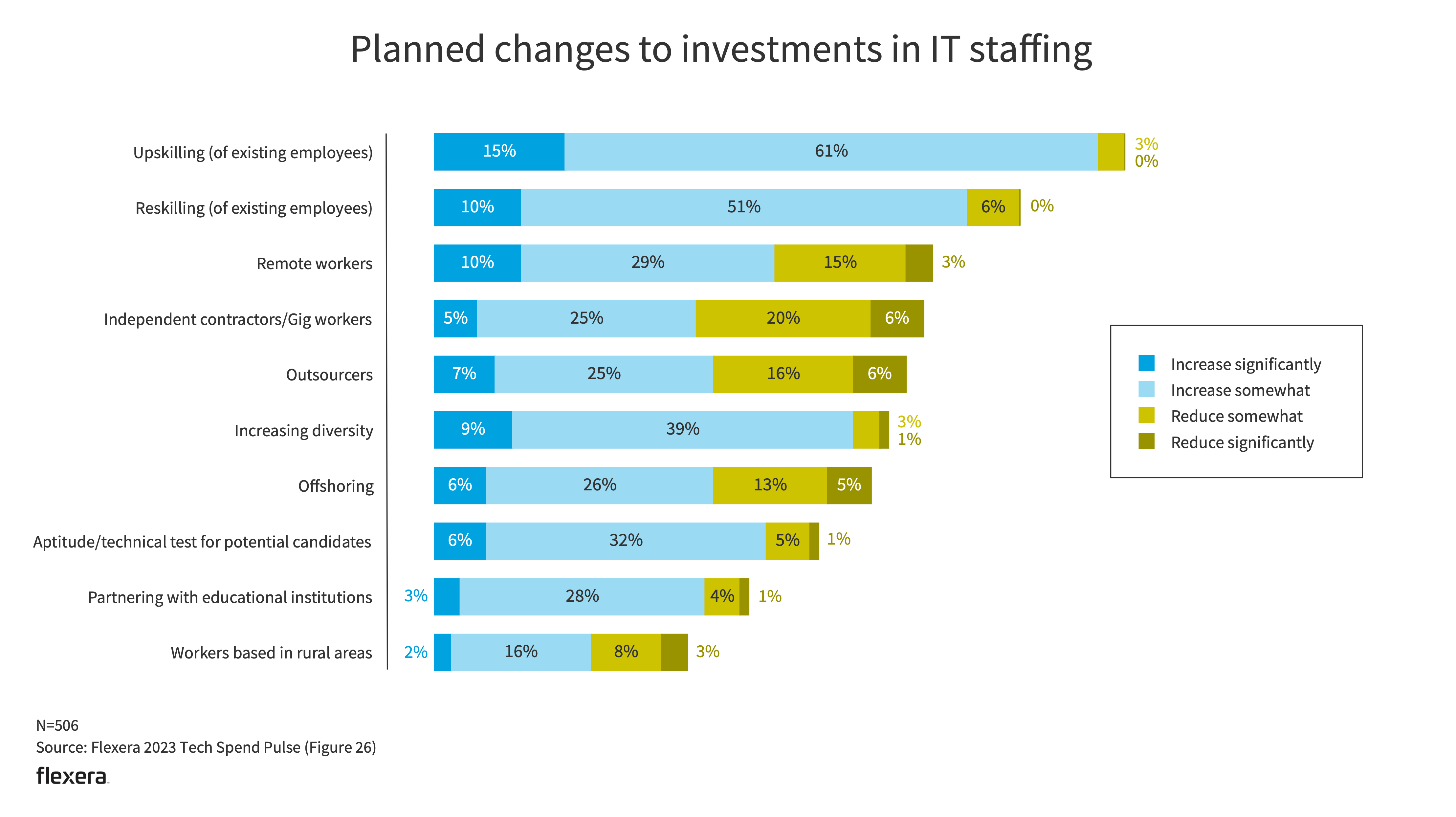

Given this trajectory, it’s imperative for enterprises to not only invest in but also upskill their workforce, refine their data strategies and build robust infrastructures and be prepared for new emerging technologies. In fact, when asked about changes to investments in IT staffing, respondents indicated that upskilling (76%) and reskilling (61%) of existing employees are top initiatives that will increase. Those that act promptly and decisively are poised to lead the next wave of innovation, leaving competitors playing catch-up.

Evolving workplace dynamics

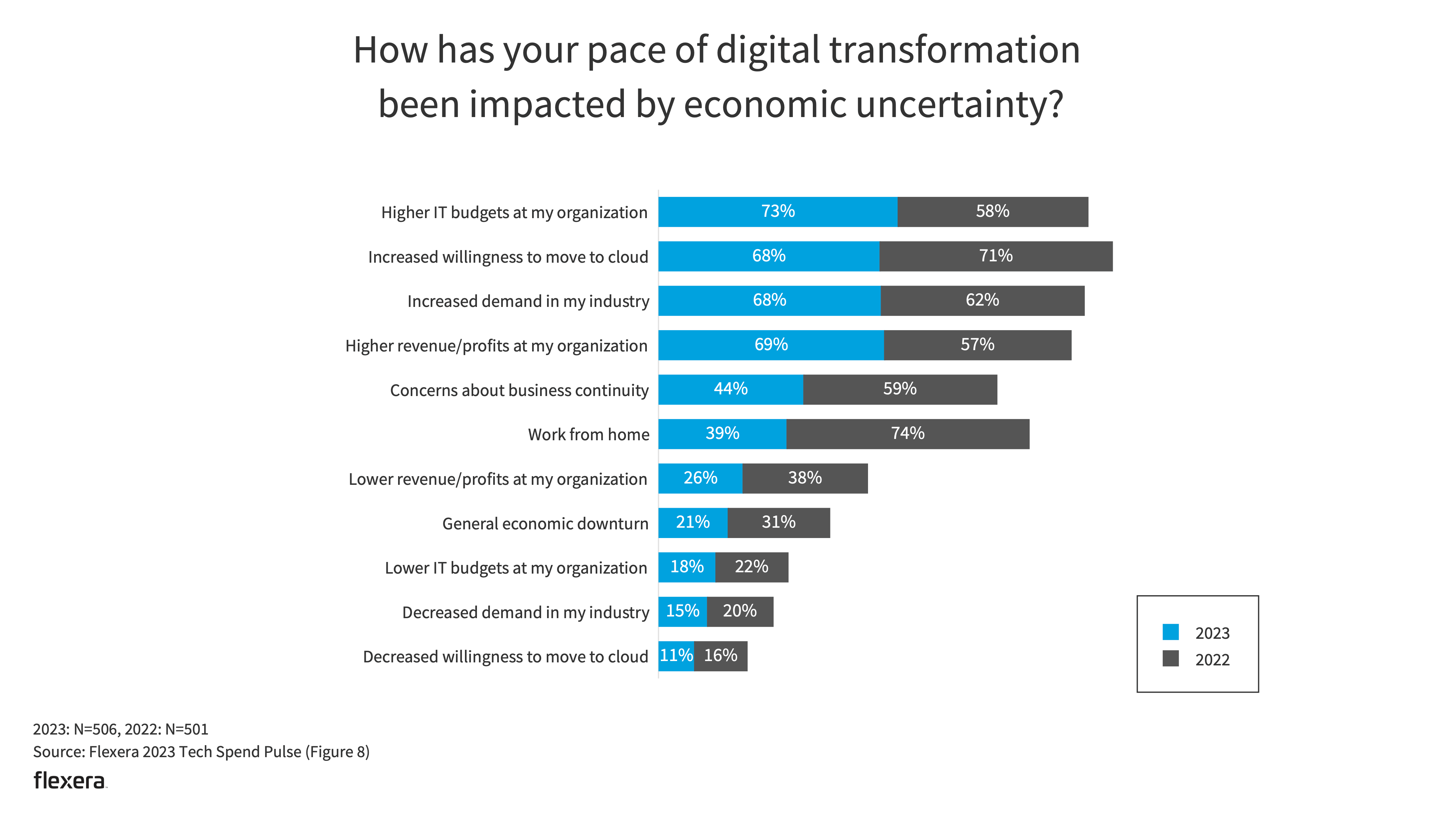

The pandemic-induced work-from-home trend was seen by many as a temporary response to unprecedented circumstances. However, as we move forward, it’s evident that its effects are more long-lasting, reshaping the future of work in profound ways. Initially, remote IT work surged to an all-time high of 74%. Recent data suggests a retraction, with remote-work rates plummeting to 39% YoY. This doesn’t signify a simple return to pre-pandemic norms. In tandem with the decline of fully remote roles, we’re observing a notable increase in hybrid work models, which have jumped from 16% to 27%. Full-time in-office IT positions have also seen growth, albeit modest, rising from 26% to 30%.

This evolving landscape points to a few key takeaways. First, while the allure of remote work remains for many, there’s a palpable desire for human connection and the collaborative spirit of a physical workplace. This shift may be attributed to the challenges posed by entirely remote structures, from collaboration hiccups to feelings of isolation. Enterprises may be actively reassessing and adapting their operational models, striving for resilience in the face of future uncertainties.

As organizations continue to grapple with these changes, it will be crucial to remain agile, listen to employee needs and industry shifts—and be ready to pivot strategies accordingly.

Technology Value Optimization

Reallocate spend. Reduce the risk of audits and security breaches. And chart the most effective path to the cloud. Get the most from every IT dollar.

Looking ahead: Embracing the digital transformation

As the pace of digital transformation accelerates, enterprises are grappling with inflationary pressures, changing work dynamics and increased spending. The demand for innovation remains high, with leading organizations leveraging comprehensive, trusted data to make informed decisions. A focus on spend optimization, coupled with a robust investment in AI’s potential, will be key to navigating this landscape.

Equip your organization with the insights needed to thrive in this ever-evolving IT world by downloading the complete 2023 Tech Spend Pulse.