This is the third in our series of Precision Planning blogs that examine the key questions which must be answered in order to effectively plan your organization’s IT for 2022.

SaaS spend is on the rise, impacting spend and reshaping your vendor landscape

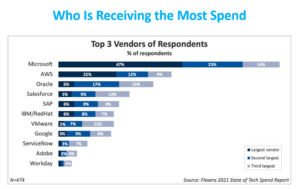

If you’re like most IT leaders, the proliferation of SaaS is changing how you view your software portfolio and spend forecasting. As recently as a few years ago, your top-spend software vendors probably consisted of the “usual suspects” of Microsoft, Oracle, IBM and SAP.

But things have changed. According to Flexera’s 2021 State of Tech Spend Report, Salesforce, ServiceNow, Google and Workday are among vendors receiving the most spend.

SaaS adoption and spend are a runaway train

And if your organization is like many others, your spend with tools like ServiceNow continues to increase quarter over quarter with little governance. Without SaaS spend optimization and risk management in place, SaaS applications become an unbridled expense.

“Our costs with ServiceNow started spiraling out of control. We were doing quarterly true-ups. So you can let as many people as you want have access to it. What you don’t understand is—and what you need to educate your users on—is there’s a charge for that. So even if the user isn’t using the application to the same extent at the end of the next quarter, you’re still paying for that. We had to really understand the ROI and make adjustments.”

-Director, Sourcing, Agriculture industry

It’s not just “born in the cloud” vendors

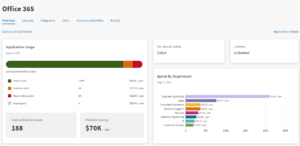

Microsoft, IBM, Oracle and SAP are also moving more of their solutions to SaaS or cloud offerings. So in order to rightsize your Microsoft contract, you need to have visibility into Microsoft’s on-prem applications, Azure and O365 usage needs.

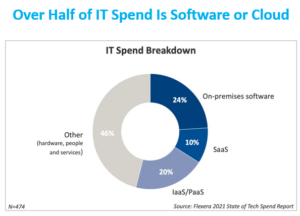

But even as more spend moves to SaaS, the adoption of SaaS management disciplines is lagging. Only 35 percent of respondents in Flexera’s 2021 State of ITAM Report say tracking SaaS usage and costs is part of the SAM team’s responsibility. This indicates that SaaS spend management is not centralized and is instead governed by business units.

Or it could suggest that 10 percent of IT spend is not being governed at all.

Follow the money

By now, your user community has probably subscribed to hundreds or thousands of SaaS applications. It’s time to get visibility into what’s happening. At the very minimum, you need to understand if ex-employees still have access to proprietary data for security purposes.

But where do you focus your SaaS cost optimization efforts? Just like with software spend, the 80/20 rule applies: 80 percent of your SaaS spend is going to be with strategic vendors like Salesforce, Workday and Microsoft O365.

The long tail of SaaS apps is interesting, but it has diminishing returns for spend optimization efforts. When you “follow the money” for SaaS optimization, you’ll free up more budget dollars to invest in innovation.

“If I look at this is a curve, you wouldn’t do the long tail of like your minimal subscriptions. You focus on ERP solutions such as Oracle, NetSuite, SAP, Workday, ServiceNow. Salesforce.com would be a big one too. Just that management and insight alone gets us a long way because that’s how they make the revenue. They divide and conquer and you end up with many contracts and costs that just keep going up.”

– Managing Director, IT, Logistics industry

Stop leaving money on the table

This means you need to look for capabilities that go beyond just SaaS discovery. Vendors like Salesforce have very complex pricing structures and a large portfolio of products. It’s not enough to simply discover salesforce.com. To optimize a complex contract like Salesforce, you need to optimize all of the modules—for example, Salesforce Marketing Cloud contacts and Salesforce App Exchange.

But even optimizing Microsoft O365 is complex, as it has both SaaS and on-premises elements. Adopting purpose-built SaaS spend optimization tools that have the ability to go deep into your strategic SaaS licenses provides actionable cost savings and meaningful ROI.

You need to see beyond discovery

Software licensing has never been simple. And SaaS licensing with large vendors like ServiceNow, Salesforce, Microsoft, Adobe and Workday is no exception. These providers have large portfolios of products that are monetized not just by number of users but also by transactions, storage, API usage and many other dimensions.

The Flexera difference

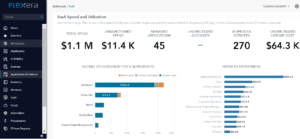

Flexera One’s SaaS Management solution goes far beyond discovery to provide true optimization of the different elements of SaaS licensing. Your largest costs aren’t just for number of subscribed users; that would be too easy. Flexera One’s SaaS Management enables you to tackle the true costs of your biggest SaaS vendors.

Flexera has been solving these SaaS spend optimization problems and saving our customers millions for more than 15 years.

IT Asset Management

It all starts with knowing what’s in your IT ecosystem. Flexera One discovers even the most elusive assets whether on-prem, SaaS, cloud, containers and more.

Flexera One helps you visualize your entire estate from on-premises to SaaS to cloud. And it delivers the power to mitigate risk, reduce costs and maximize every technology investment—so you can invest in innovation.

See where you can take your SaaS management

Our comprehensive guide helps you get the answers you need to accelerate the return on your IT investments and achieve technology value optimization. Find out how you can support the agility of SaaS adoption while governing its costs and usage—so everyone in your organization wins.