Table of contents

Do not edit: TOC will be auto-generated

There’s a boom echoing through the FinOps tooling market

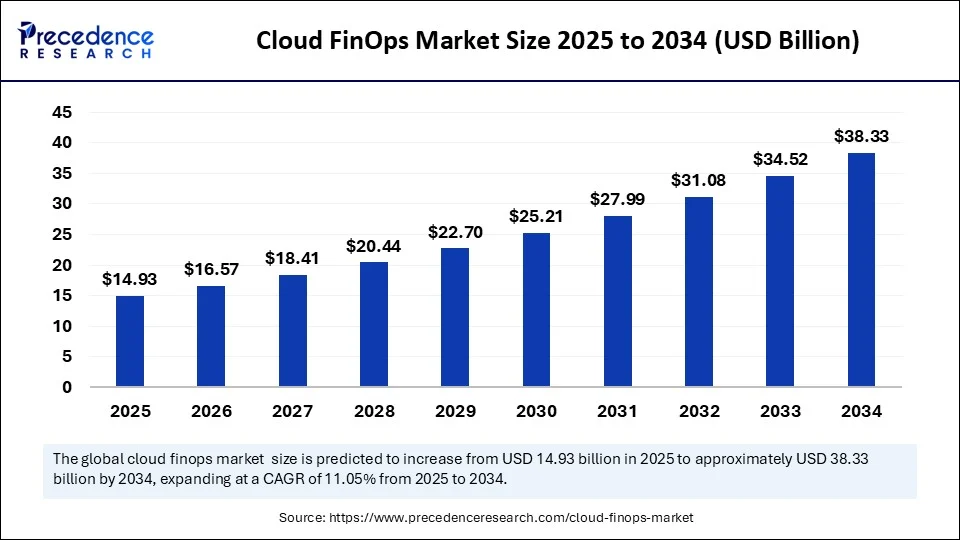

An explosion of tooling options might seem like a blessing in some markets, and with IT costs growing by the minute, it’s especially critical to pay attention to the boom happening in FinOps. It’s hard to miss that rapid growth; the global cloud FinOps market is expected to expand from $14.93 billion in 2025 to approximately $38.33 billion by 2034, with a projected compound annual growth rate (CAGR) of about 11% indicating steady long-term adoption.

This expansion is driven by the increasing need for cost transparency and financial accountability in cloud environments. With hundreds of tools now claiming to offer “FinOps support,” the true challenge lies in making a smart selection in such a crowded market. If you need proof of just how cramped it is, take a peek at the array of sponsors FinOps X had in 2025—a noticeable increase compared to previous years.

The looming challenge? Too many choices

The FinOps tooling market may be overflowing with platforms that promise cost optimization, but unfortunately, they don’t all have the same feature set or purposes. Options range from niche resource tuners to broad cloud management suites:

- Cloud-native tools

- Point solutions

- Service providers

- FinOps platforms

Cloud-native tools work well in instances where you’re on one cloud, but they lack comprehensive visibility, while point solutions handle one or two aspects of FinOps but don’t cover all capabilities. Very few tools offer the deep, end-to-end functionality needed across infrastructure as a service (IaaS), software as a service (SaaS), container environments, and sustainability goals like a FinOps platform does.

Must-have criteria for selecting a FinOps tool

When selecting a FinOps tool, look for a breadth of key capabilities, including:

- Data ingestion, including FOCUSTM support

- Effective forecasting, planning, and estimating

- Budgeting per team, application, or program

- Allocation, invoicing, and chargeback

- Workload optimization

- Rate optimization

- Reporting and analytics

- Anomaly management

- Policy governance

- Cloud sustainability

- Support for intersecting disciplines like IT asset management and licensing

Most solutions excel in one or two of the above capabilities, but few solutions have it all.

Finding the right FinOps tool that plugs into your organization with adequate functionality goes beyond a feature checklist. You also need to examine solutions for their depth of coverage, scalability, and reliability to ensure that your tool or platform of choice will stand the test of time (and the test of growth).

It’s also mission-critical that your organization focuses on creating a culture of cost savings through collaboration, education, and enablement so that everyone is taking ownership for cloud costs. Part of that culture shift is operating with FinOps practice operations in mind, such as defining evolving team skills, fostering critical stakeholder relationships, and positioning the FinOps team positively within the organization.

Ease of use and depth of coverage: the sweet spot

Every new piece of software, application, or project adds to the overload engineering teams face daily. The solutions you put in front of them should be easy to use, reduce operational overhead, and decrease technical debt. When evaluating FinOps tools, consider the importance of user-friendly interfaces and integrations with existing tools so that your engineering teams aren’t slowed down by cost considerations.

Seamless workflows enable you to hit the ground running, and depth of coverage means your teams can access every corner of their IT environment so that they don’t miss opportunities for improvement. With a potential impact on the entire organization, the ability to more easily manage the cost of your applications through their lifecycle means less headache, less money wasted, and more room for productive innovation.

Taking a holistic approach to FinOps

With FinOps evolving so quickly and new tools emerging on the market, embarking on a holistic approach with a platform that provides depth and flexibility is key. Without solutions that can scale as your organization grows, and that can keep up with the shifting market, you run the risk of minimizing business value and overspending on software.

“FinOps is maturing fast—and companies need tools that keep pace with that evolution. It’s not about tracking costs; it’s about managing change.” — Jay Litkey, Executive Vice President, Cloud Management at Flexera

When evaluating FinOps tools, choose a solution that covers your cloud environment, on-premises environment, and workload migration, all while supporting your organization in making critical cultural changes with FinOps best practices. Managing the lifecycle of IT assets and licenses is also crucial for a look at total cost of ownership. By selecting a solution that is proven in the market and stays on top of rapid changes with research and consistent innovation, you reduce your risk of falling behind.

Already have a tool in hand? Here’s when to upgrade

If your current tool is falling short in critical areas like cross-cloud visibility, automated governance, or container cost management—or if it doesn’t give visibility into your hybrid infrastructure at all—it may be time to rethink what you have.

A modern FinOps platform that can address challenges around multi-cloud cost allocation, efficient resource usage, and control at scale is essential to align business, engineering, and finance teams. A comprehensive solution gives each of these stakeholders their relevant view of cost, usage, and optimization opportunities, so IT can adjust resource decisions as business needs shift with changes in the economy and the market.

If you’re new to FinOps tooling, start with the right foundation

Brand new to FinOps tools? You’re not alone in that journey. If you’re just getting started, the temptation is to go with low-cost native tooling or point solutions—but that can lead to siloed data, fragmented workflows, and hidden costs. Instead, look for a comprehensive platform that can grow with your needs and that unites ITAM, SaaS, and FinOps in one interface.

“Enterprises don’t need another tool. They need a partner that understands how to connect cost, usage, and accountability across the organization.” — Jay Litkey, Executive Vice President, Cloud Management at Flexera

With a FinOps platform that has the full set of features and capabilities, it’s easier to build a culture around cost transparency and financial accountability that all teams follow. Taking a proactive approach to FinOps means businesses can stay ahead of the curve when it comes to mounting cloud costs and optimization needs.

There are a lot of fish in the FinOps sea, but Flexera is the best catch

A new IDC report surveyed global enterprises to determine who is leading the pack in several key categories, such as cloud resource optimization, cloud SaaS management, and reporting and pricing. Only three were recognized as offering the full depth of capabilities enterprises need—and Flexera is one of them, showing up in all relevant categories for tooling providers. (Access the full IDC report).

Flexera was also recently named a Leader (for the second year in a row) in the Gartner Magic Quadrant for Cloud Financial Management Tools as well as in The Forrester Wave: Cloud Cost Management and Optimization, Q3 2024. These recognitions by top-tier analysts are evidence of Flexera’s continued leadership in FinOps.

The proof is in customer feedback as well:

“Cloud Cost Optimization gives us unprecedented insight into the state of our cloud spend so we can better leverage our cloud investments.” – Laurent Gaertner, Director of Global Network and Hosting, Carlsberg Group

Flexera customers benefit from our solutions every day as they gain visibility and allocate their cloud spending more effectively. It all comes wrapped up in a comprehensive package:

- A single interface for FinOps, ITAM, and SaaS means you have everything at your fingertips

- Multi and hybrid cloud reporting delivers a total cost of ownership view with complete cost allocation

- Actionable usage recommendations can be tuned to your workload needs to reduce resource waste without sacrificing performance

- Intelligent recommendations for purchasing and exchanging commitment discounts can be manually or automatically applied for continuous coverage

- Hundreds of out-of-the-box and customizable policies trigger automated alerts and actions to control your environment at scale

Let’s rethink FinOps, together

No matter where you are in your FinOps journey—from investigating cost spikes to proactively managing a rapidly changing fleet of resources—Flexera is here to help you simplify the process and drive business value.