Table of contents

Do not edit: TOC will be auto-generated

Introduction

Cloud computing has become an indispensable part of business operations. However, with the immense flexibility and scalability that cloud offers comes the challenge of managing and optimizing decentralized cloud costs effectively. This is where FinOps comes into play. FinOps is a framework and practice that helps organizations align cloud usage and costs with business goals. This guide will delve into what FinOps entails, its core components, how it differs from traditional cost management and its relevance for businesses of all sizes.

What is FinOps?

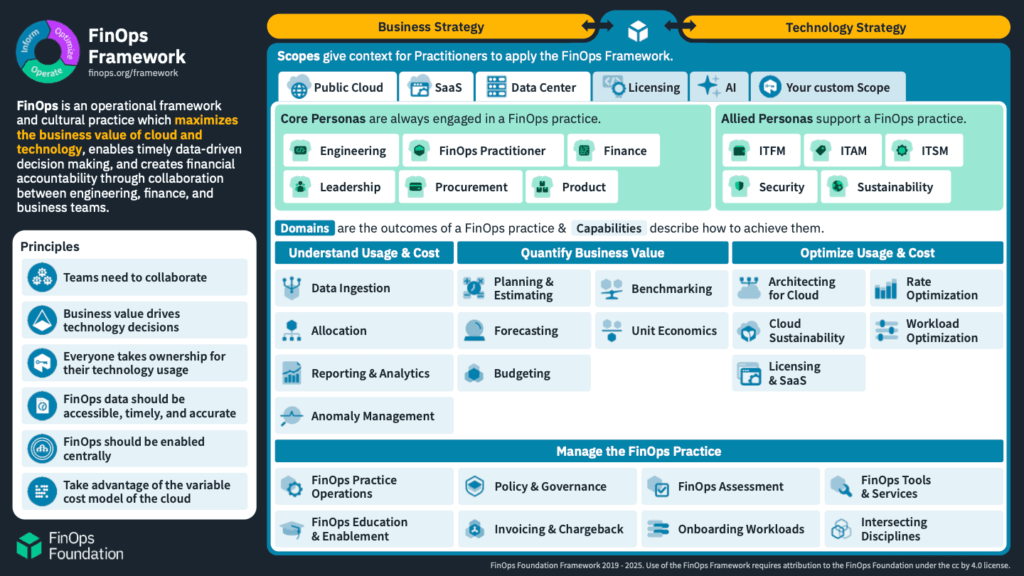

According to the FinOps Foundation, “FinOps is an operational framework and cultural practice which maximizes the business value of cloud and technology, enables timely data-driven decision making, and creates financial accountability through collaboration between engineering, finance, and business teams.”

The word “FinOps” is a portmanteau of “Finance” and “DevOps,” reflecting the collaboration it requires between business and technology teams. FinOps brings business leadership, finance, product and engineering teams together to ensure that cloud spending is aligned with business goals. The practice of FinOps helps you gain visibility into your cloud expenses, allocate costs to specific business units and outcomes and make informed decisions about resource usage and cost optimization.

The FinOps Framework

The FinOps Framework has been developed iteratively by real-world practitioners and the FinOps Foundation. The Framework offers building blocks for a FinOps practice and encompasses the core principles, personas, phases and capabilities of a FinOps practice.

Key components of a FinOps practice

- Cost visibility: Granular visibility into cloud spend is a crucial foundation to FinOps success. Visibility into usage and cost at the resource level helps you identify baseline spend, cost trends, anomalies and potential areas for optimization.

- Cost allocation: Allocating cloud costs to different business units, projects, teams and applications is necessary for financial accounting and resource optimization. Full allocation enables finance teams to reconcile cloud invoices and perform chargebacks, product management teams to tie spending to business outcomes that are achieved using cloud resources, and engineers to optimize cloud resource usage to maximize business value.

- Budgeting and forecasting: The dynamic and decentralized nature of cloud operations, combined with the cloud’s pay-as-you-go pricing model, makes forecasting costs and setting budgets more challenging than with traditional private data center operating models. FinOps gives finance teams visibility into who is spending what in the cloud, enabling more accurate forecasts and the establishment of appropriate budgets for different projects or teams.

- Usage optimization: Choosing cloud resources that optimize workloads and application performance while minimizing cost is a key component of FinOps, and requires deep collaboration between FinOps practitioners and DevOps teams. Resource usage optimization can include rightsizing instances, using spot instances, and auto-scaling based on demand.

- Rate optimization: FinOps outlines best practices for taking advantage of cloud provider discounts such as Reserved Instances, Savings Plans, and Committed Use Discounts. These commitment-based discounts offer reduced rates in exchange for a commitment to use specified cloud resources and services.

- Collaboration: FinOps requires collaboration between various stakeholders, including engineering, finance and business teams. This collaboration ensures cloud initiatives and spending stay aligned with your organization’s objectives as they shift to meet customer and market needs.

- Tools and automation: Dedicated FinOps tools help you manage, optimize and govern cloud costs at scale. Comprehensive solutions enable stakeholders to perform all FinOps activities and provide insights, recommendations, and automation to streamline the FinOps process.

- Continuous improvement: FinOps is not a one-time effort but an ongoing process of analyzing and optimizing cloud costs as resources change and as business priorities shift. Frequent analysis and adjustments are critical to achieve optimal usage at minimal cost, and automation enables governance at scale with decentralized cloud operations.

By adopting FinOps, you can achieve better cost visibility, make data-driven decisions and maximize the value you get from your cloud investments.

How does FinOps differ from traditional cost management?

Unlike traditional on-premises environments where procurement and finance teams closely monitor and manage infrastructure purchases in the cloud, software developers and operations (DevOps) teams—and the code they write—can quickly spin up new resources, often without any formal processes or oversight. This immediate access to required resources gives organizations the agility they seek to stay ahead of their competition, but it leaves finance and procurement teams in the dark, and can generate cloud spend waste through infrastructure inefficiencies and sprawl.

FinOps focuses on tackling dynamic, real-time usage and associated costs in the cloud. It involves granular analysis of cloud billing data, collaboration to allocate and optimize resource usage and costs, and continuous monitoring to adapt to rapidly changing resource needs and shifting business priorities. FinOps is a continuous cycle of iterative adjustments, as well as policy development to scale the practice in a decentralized operating model.

Is FinOps relevant for all businesses?

FinOps is relevant for organizations of all sizes, across all industries, when operating in the public cloud. Smaller businesses can benefit from cost savings and improved resource management, just like larger enterprises. Additionally, implementing FinOps practices early on in your cloud journey can help establish a culture of growth with cloud cost management in mind.

Challenges in implementing FinOps

As with implementing any new practice, there can be obstacles along the way. Challenges organizations can encounter when first implementing FinOps can include a lack of granular cost visibility, resistance to making infrastructure changes and the complexity of managing pricing discounts. The FinOps Foundation recommends taking a “crawl, walk, run” approach with each FinOps capability to ensure your overall practice meets the current needs of the organization without applying innovation-stalling rigidity.

Benefits of FinOps

- Improved cost visibility and allocation

- Accurate forecasting and budgeting

- Accountability for costs by engineering teams

- Efficient resource utilization

- Data-driven decision-making

- Scalable governance

- Ability to quickly respond to changing business demands

How Flexera can help

Flexera One FinOps provides a comprehensive platform that empowers organizations to operationalize their FinOps practice. Our platform offers:

- Unified cloud cost visibility: Gain a single pane of glass view into all your cloud spending across multiple providers and unify with SaaS, license and on-premises cost data

- Granular cost allocation: Accurately allocate cloud costs to your own business units, projects, teams or applications

- Budgeting and forecasting tools: Create accurate forecasts and budgets for cloud spend, and monitor performance against them

- Actionable optimization recommendations: Rightsize resources according to recommendations that are adjustable for custom compute, memory and storage requirements

- Strategic rate optimization: Purchase recommended commitment discounts (e.g., Reserved Instances, Savings Plans) and leverage automation to ensure complete coverage of resources

- Governance and automation: Implement policies and automate actions to ensure continuous cost optimization and compliance at scale

By leveraging Flexera’s FinOps platform, you can achieve greater control over your cloud environment, maximize ROI and drive more business value.

Maximize your cloud resources

FinOps is more than just a set of tools; it’s a cultural shift that brings financial discipline to cloud spending. By fostering collaboration, enhancing visibility and promoting continuous optimization, FinOps empowers organizations to make smarter decisions about their cloud investments. Whether you’re a small business or a large enterprise, adopting FinOps practices is crucial for maximizing the value of your cloud resources and achieving sustainable growth in the cloud era.

Ready to implement FinOps and optimize your cloud spending? Contact Flexera today for a personalized consultation on our cloud cost optimization solutions.