As digital transformation continues to advance through organizations of all sizes and across all industry verticals, how these organizations prioritize, forecast and budget IT spend shifts as a byproduct of this evolution. The challenges these organizations face in forecasting and allocating their IT dollars are evolving as new and emerging technologies mature to address their transformational needs.

This year’s 2022 Flexera Tech Spend Pulse Report, a continuation and expansion of our annual State of Tech Spend Report, identifies the latest IT spending benchmarks and trends. This report is based on responses from more than 500 enterprise CIOs and IT executives who are driving digital transformation within their organizations. The report enables enterprises of every size and across every industry to analyze IT spend trends and benchmark against peer organizations.

There are many key highlights especially relevant to organizations dealing with fast-paced hybrid IT environments. The 2022 Flexera Tech Spend Pulse uncovered what’s trending in large and medium enterprises, highlighting the noteworthy and sometimes dramatic shifts since last year’s report was published. The COVID-19 pandemic continues to impact and influence IT spend. It has forced organizations to accelerate digital transformation efforts to support major changes in how and where people work and to mitigate negative impacts of the economic downturn. Nearly half of IT staff members now work from home, and time frames for returning to the office are uncertain.

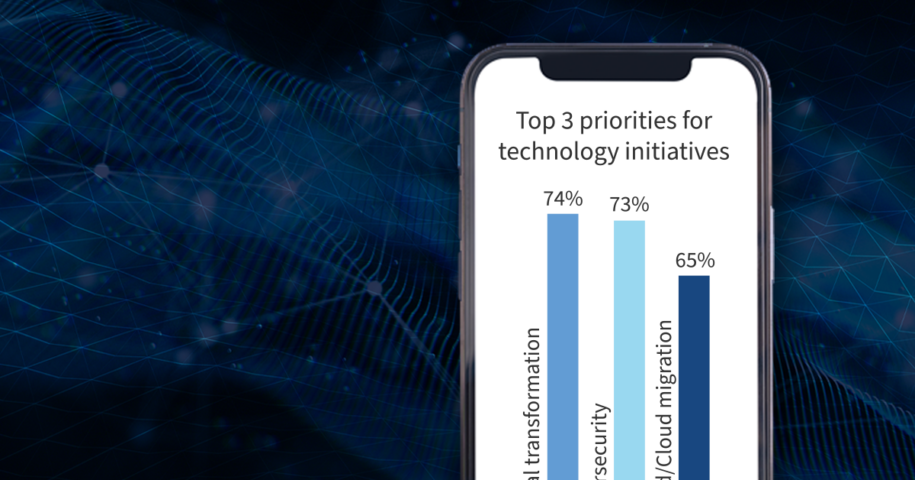

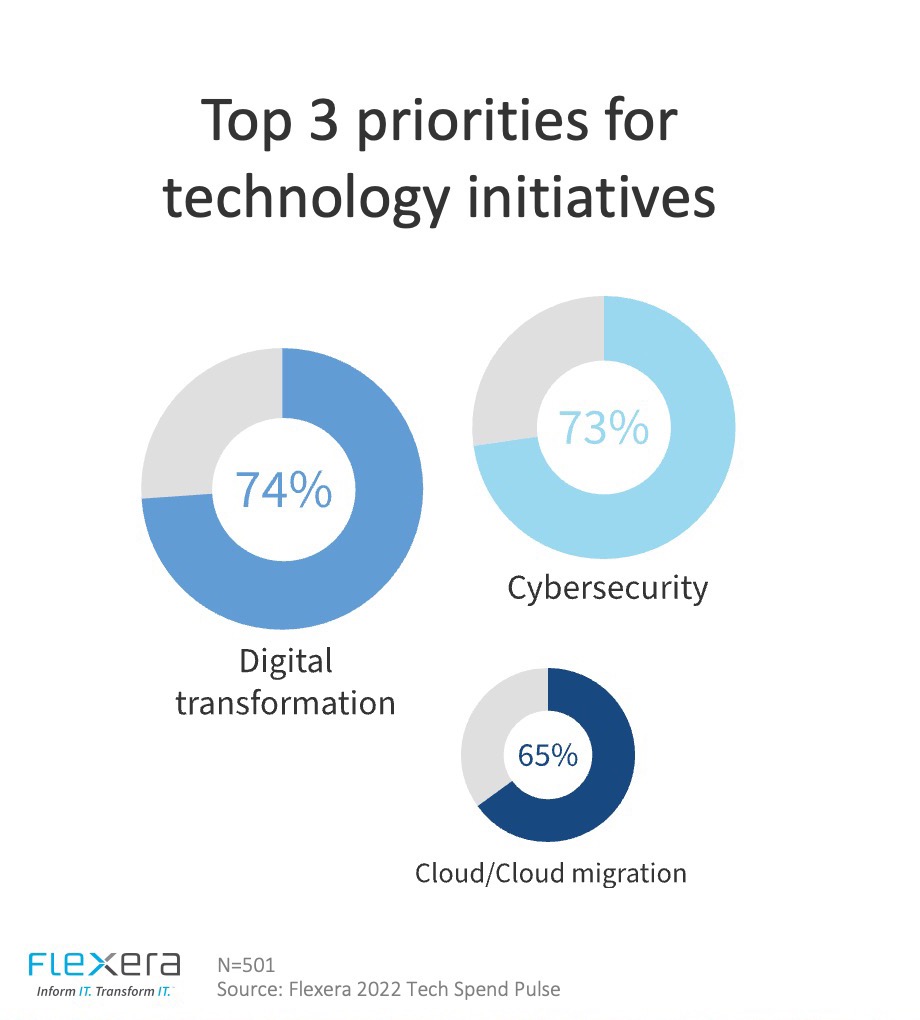

Top technology initiatives

As with last year’s report, the survey showed that the top three priorities for technology initiatives were digital transformation, cybersecurity, and cloud/cloud migration. As the push for a more flexible workforce continues, along with the advantageous business and operational models that digital services provide, digital transformation initiatives continue to advance. Along with this push to digitization comes more stringent requirements around digital asset security, and thus cybersecurity is close behind. And a large component of many organizations’ digital transformation journey involves the use of public cloud services, thus the emphasis on cloud migration efforts.

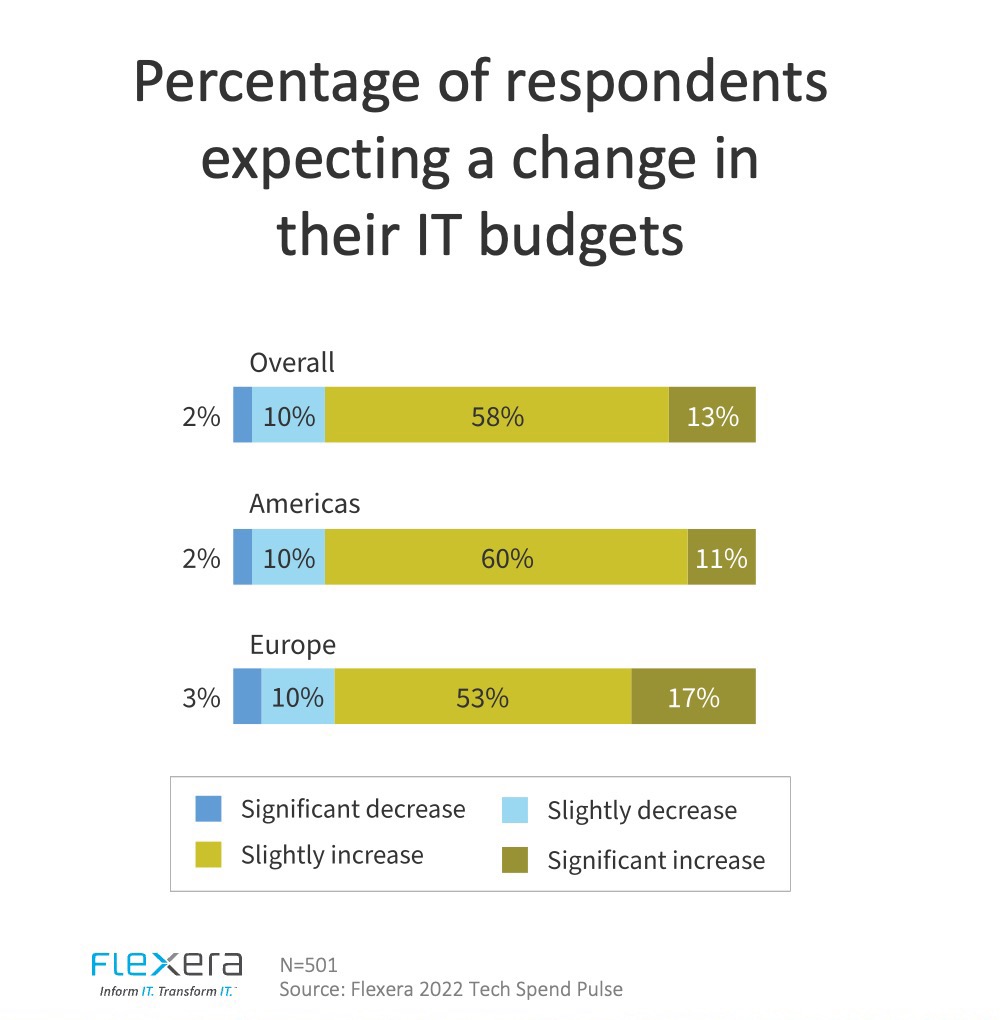

IT budgets are growing

As this global push for digital transformation accelerates, budgets allocated to these digital initiatives are understandably increasing to accommodate the needs and requirements of these transformational efforts. As in year’s past, we surveyed respondents concerning their expectations of their IT budgets in the coming year. Regardless of the global region, over seventy percent of respondents indicated that they expect an increase in their IT budgets in the coming year, with thirteen percent of global respondents expecting a significant increase.

The original Tech Spend Pulse survey was conducted prior to the global sanctions imposed on Russia due to the conflict in Ukraine. In an abbreviated survey conducted after the sanctions were in place, 411 respondents were asked several follow-up questions. The results of that survey indicated that global respondents’ expectations of increases in their IT budgets declined slightly from seventy-one percent to sixty-four percent.

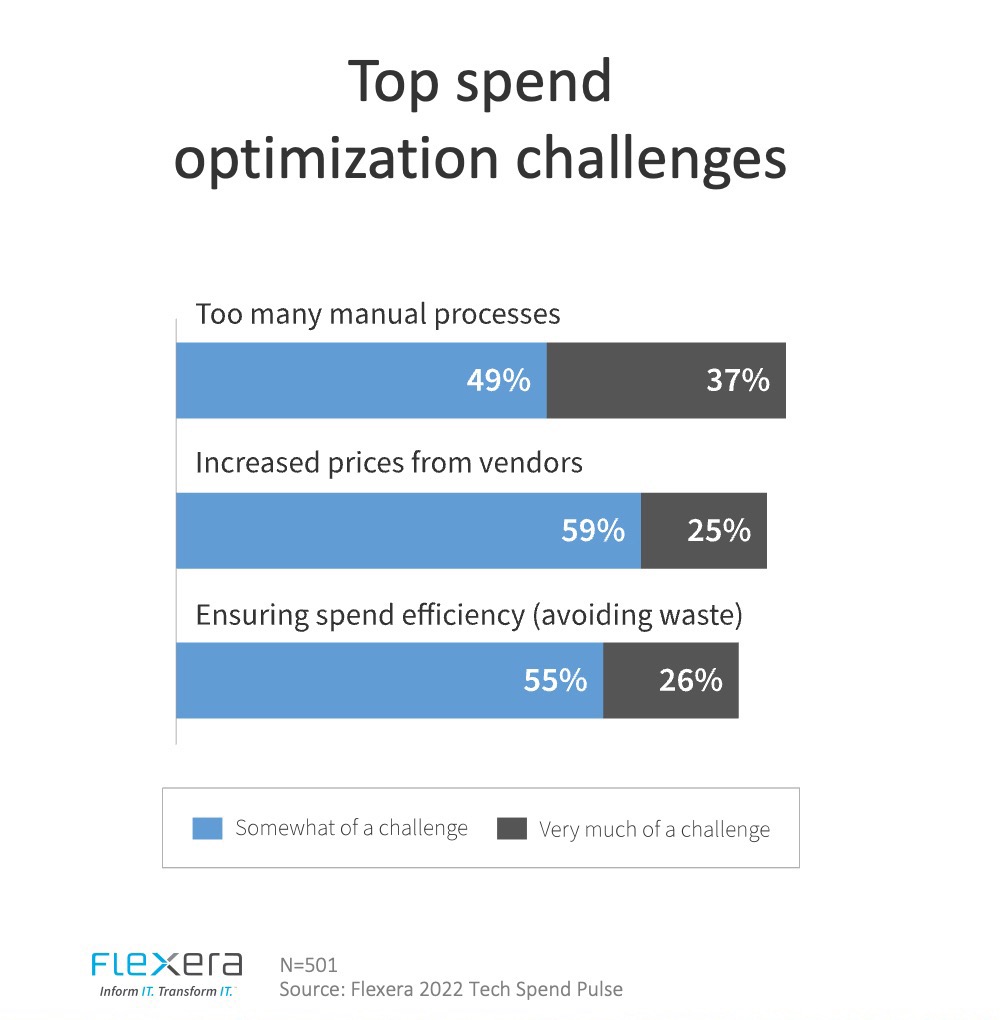

Challenges in managing IT spend

Respondents were asked about the challenges they face in managing their IT spend. As organizations pursue their digital transformation efforts, they continue to encounter manual processes that hinder the digitization of these efforts. As such, this year’s top challenge was unchanged from last year – too many manual processes. Rounding out the top three spend challenges are increased prices from vendors and ensuring spend efficiency (avoiding waste), both increasing from last year where they were in seventh and fourth place, respectively.

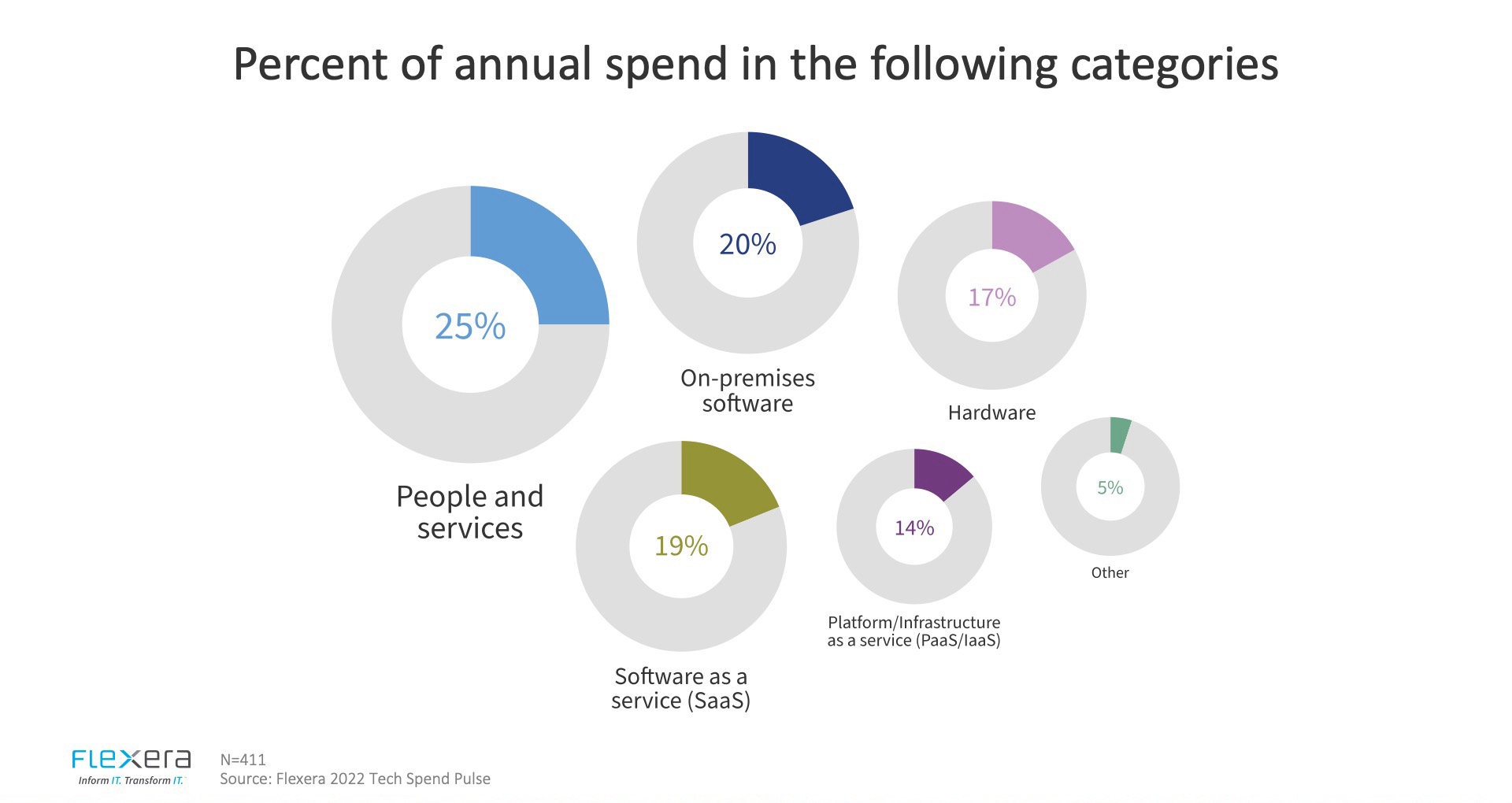

Total spend breakdown

Digital transformation efforts result in organizations moving away from classic on-premises IT models and leaning more toward cloud and cloud services. This is reflected in this year’s data, which indicates that a third of IT spend is on SaaS, PaaS, and IaaS offerings. On-premises software spend has decreased from twenty-four percent last year to twenty percent this year, while SaaS spend has almost doubled from ten percent to nineteen percent this year.

Technology Value Optimization

Reallocate spend. Reduce the risk of audits and security breaches. And chart the most effective path to the cloud. Get the most from every IT dollar.

IT Initiatives, benchmarks, challenges and more

IT cloud cost management software such as Flexera One enables visibility into the data needed for the digital transformation journey, from understanding current on-premises costs and software license entitlement positions to handling cost-to-cloud and ongoing optimization of IaaS, PaaS and SaaS services. Flexera helps customers optimize both on-premises and cloud spend as they navigate the shifting technology landscape, regardless of the vendors they choose.

To gain further insights into IT spending trends and benchmarks, review and download the full survey results in the Flexera 2022 Tech Spend Pulse or reach out to a Flexera expert to learn more about this data and how we can support your efforts.